In today’s fast-paced world, small businesses need to stay agile and efficient. Traditional accounting methods can feel cumbersome, leaving entrepreneurs bogged down in paperwork instead of focusing on growth. Enter online accounting—a game changer for finance management that is revolutionizing how small businesses operate.

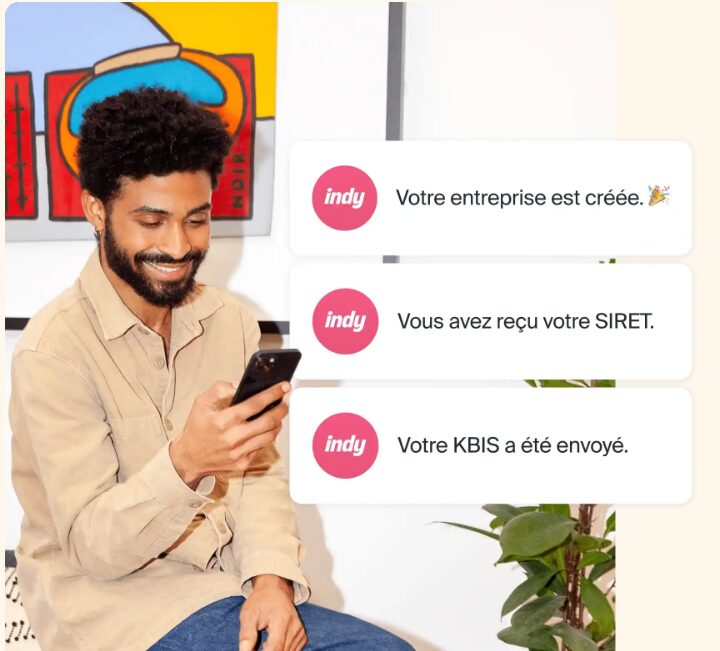

Indy Online Accounting stands at the forefront of this evolution, offering a modern solution tailored to meet the unique needs of small enterprises. With its intuitive interface and powerful features, it simplifies financial tasks while enhancing accuracy and accessibility. As more business owners embrace digital tools, understanding the advantages of Indy Online Accounting becomes essential for anyone looking to thrive in an increasingly competitive landscape.

The Rise of Online Accounting

The rise of online accounting has transformed the way businesses manage their finances. As technology advances, entrepreneurs seek efficient solutions to streamline operations.

Cloud-based platforms have become increasingly popular, allowing users to access financial data anytime and anywhere. This flexibility is a game changer for small business owners who often juggle various responsibilities.

Moreover, online accounting software reduces reliance on manual entry and minimizes errors. Automation features handle routine tasks like invoicing and expense tracking with ease.

As more companies recognize these benefits, the shift from traditional methods accelerates. The convenience of real-time updates ensures that decision-makers stay informed at all times.

With continuous improvements in user experience and functionality, it’s clear that online accounting is not just a trend—it’s an essential tool for modern small business finance management.

Benefits of Indy Online Accounting for Small Businesses

Indy Online Accounting streamlines financial management for small businesses. It offers flexibility that traditional accounting methods can’t match. Business owners can access their financial data anywhere, anytime.

Real-time updates make it easy to track expenses and income. This immediacy empowers decision-making and helps identify trends quickly. Small business owners no longer have to wait for monthly reports to understand their finances.

Collaboration is seamless with Indy’s cloud-based platform. Team members or accountants can work together in real time, enhancing communication and efficiency.

Cost-effectiveness is another significant advantage. Subscriptions are typically less expensive than hiring full-time staff or outsourcing services, allowing more funds to be allocated toward growth initiatives.

Moreover, user-friendly interfaces require minimal training, making the transition smooth for any business owner eager to embrace modern technology without a steep learning curve.

Top Features of Indy Online Accounting Software

Indy Online Accounting Software boasts a user-friendly interface that simplifies even the most complex financial tasks. Its intuitive dashboard allows business owners to view real-time financial data at a glance.

One standout feature is automated invoicing. Users can create and send invoices with just a few clicks, significantly reducing administrative workload. Customization options let businesses tailor invoices to reflect their brand identity.

Another impressive aspect is expense tracking. The software integrates seamlessly with bank accounts, capturing transactions automatically. This means no more manual entries or lost receipts.

Collaboration tools enhance teamwork by allowing multiple users access based on their roles. This flexibility ensures everyone stays informed while maintaining data security.

Robust reporting capabilities provide insights into cash flow, profit margins, and other critical metrics. Such information empowers small business owners to make informed decisions swiftly.

Cost Comparison: Traditional vs. Online Accounting

When weighing traditional accounting against online options, the cost differences are striking. Traditional accounting often involves hefty fees for in-person services and additional expenses like office space and equipment.

Online accounting platforms usually operate on subscription models. This means predictable monthly costs without surprise fees lurking around the corner. You pay for what you need, scaling services as your business grows.

Moreover, hidden costs in traditional setups can add up quickly—think travel time, printing documents, or even hiring administrative staff to manage records. Online solutions eliminate these extra layers of expense.

Consider long-term savings with cloud-based systems that automate many tasks traditionally handled by human accountants. This efficiency translates into reduced labor costs and faster financial reporting cycles, making it a compelling choice for savvy small businesses aiming to streamline their finances.

Security and Data Protection in Indy Online Accounting

In today’s digital landscape, security is paramount. Indy Online Accounting understands this need and employs robust measures to protect sensitive financial data.

Data encryption stands at the forefront of their security strategy. This ensures that information remains confidential during transmission and storage. Unauthorized access becomes nearly impossible.

Regular software updates are another layer of protection. By staying current with the latest security protocols, Indy minimizes vulnerabilities that cyber threats may exploit.

User authentication mechanisms add an extra barrier. With multi-factor authentication options available, businesses can ensure only authorized personnel have access to critical financial records.

Indy also adheres to stringent compliance standards, which reinforces trust among users. They prioritize transparency in how they handle and store data.

Businesses can focus on growth without constantly worrying about potential breaches or losses. The emphasis on security allows for a more relaxed approach to finance management, knowing that their data is safeguarded effectively.

Future Predictions for Indy Online Accounting

The future of Indy Online Accounting is set to be transformative. As technology evolves, so too will the capabilities of online accounting platforms. We can expect advanced AI integration that automates tasks like data entry and expense tracking.

Moreover, real-time analytics will become more sophisticated. Small businesses will benefit from instant insights into their financial health, making informed decisions quicker than ever before.

Collaboration features may also see significant enhancements. Teams spread across different locations could seamlessly access shared accounts while maintaining a secure environment.

As regulatory landscapes shift, Indy Online Accounting will likely adapt with built-in compliance tools tailored for various industries. This evolution promises not only efficiency but also peace of mind for small business owners navigating complex financial waters.

Conclusion

The shift toward online accounting represents a transformative moment for small businesses. As technology continues to evolve, tools like Indy Online Accounting are at the forefront of this change. They offer streamlined solutions that not only enhance productivity but also reduce stress associated with financial management.

By embracing online accounting, small businesses can access a range of powerful features tailored to their needs. The ease of use and cost savings make it an attractive option for entrepreneurs looking to focus on growth rather than paperwork.

With strong security measures in place, business owners can feel confident knowing their data is protected against potential threats. This level of assurance allows them to concentrate on what truly matters—their business goals.

As we look ahead, the future seems bright for online accounting services. Small businesses stand ready to embrace innovations that will further simplify financial processes and unleash new opportunities for success.

Adopting Indy Online Accounting isn’t just about keeping up; it’s about leading the way into a more efficient and effective future in finance management. Embracing these advancements today could very well define tomorrow’s business landscape.