Introduction to Krisp Crypto Tax Software

Navigating the world of cryptocurrency can be both exciting and daunting. As digital currencies continue to gain popularity, so too does the need for efficient tax reporting solutions. Enter Krisp Crypto Tax Software—a game-changer in simplifying how you handle your crypto taxes. If you’re tired of sifting through endless transactions and worried about looming deadlines, Krisp is here to alleviate that stress. With innovative features designed specifically for crypto investors, it’s time to discover how this software can transform your tax experience while maximizing your savings. Say goodbye to confusion and hello to clarity!

How Krisp can help with tax reporting for cryptocurrency investments

Krisp simplifies tax reporting for cryptocurrency investments. It automates the complex calculations required to accurately report your gains and losses.

With its user-friendly interface, you can easily input your transaction data. Krisp then organizes this information into clear reports ready for filing. No more spreadsheets or manual entry errors.

The software connects seamlessly with exchanges and wallets, retrieving your transaction history effortlessly. This saves you hours typically spent gathering documents.

Additionally, Krisp stays updated on the latest tax regulations related to cryptocurrencies. This ensures compliance while maximizing potential deductions.

By using Krisp, you’re not just streamlining the process; you’re also gaining peace of mind knowing everything is handled correctly and efficiently.

Benefits of using Krisp over traditional methods

Using Krisp has distinct advantages over traditional tax reporting methods. For one, it automates the tedious process of tracking transactions. No more spreadsheets or manual calculations.

Krisp also integrates seamlessly with popular exchanges and wallets. This means you can pull transaction data directly without any hassle. Traditional methods often require you to collect information from various sources manually, which is time-consuming.

Another benefit is accuracy. Krisp minimizes human error in calculations by using sophisticated algorithms designed for crypto tax compliance. With traditional methods, even a small mistake could lead to significant consequences.

Moreover, Krisp provides user-friendly dashboards that make navigating your tax situation simple and clear. Traditional systems can often feel overwhelming with their complex forms and jargon-heavy language.

The cost-effectiveness of Krisp cannot be overlooked either; it saves users money on potential accountant fees associated with conventional processes.

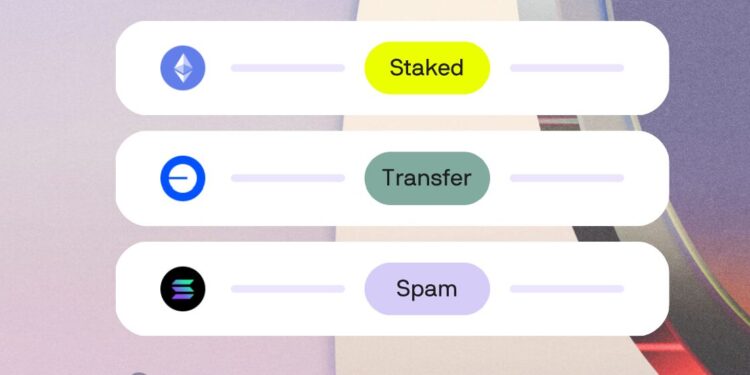

Features and tools offered by Krisp

Krisp Crypto Tax Software boasts an impressive array of features tailored for cryptocurrency investors. Its user-friendly interface ensures that both beginners and seasoned traders can navigate it effortlessly.

Automated transaction importing streamlines the process, allowing users to sync their wallets and exchanges without manual input. This saves a significant amount of time, which is crucial during tax season.

The software also offers advanced reporting tools. Users can generate detailed reports for capital gains and losses at the click of a button. This clarity helps in understanding one’s financial position better.

Additionally, Krisp provides real-time updates on changing tax regulations related to cryptocurrencies. Staying compliant has never been easier with such timely information at your fingertips.

With multi-currency support, investors dealing in various digital assets find Krisp particularly beneficial. It consolidates everything into one platform, eliminating confusion across multiple accounts or currencies.

Real-life examples of how Krisp has saved users time and money

Many users of Krisp have shared their success stories. For instance, Sarah, an avid crypto trader, managed to file her taxes in just under 30 minutes this year. She previously spent hours sorting through spreadsheets and receipts.

Then there’s Mike, who faced a hefty penalty for misreporting last tax season. After using Krisp’s automated calculations and insights, he accurately reported his gains and was able to claim several deductions he didn’t know existed.

Another user, Jenna, highlighted how the software helped her track multiple transactions seamlessly. Instead of manually inputting data from various exchanges, she synced everything with Krisp in one go.

These real-life examples illustrate just how powerful Krisp can be in not only saving time but also preventing costly mistakes that can arise during tax reporting. Users are discovering more efficient ways to manage their cryptocurrency finances while staying compliant with regulations.

Testimonials from satisfied customers

Krisp has transformed the way many users handle their crypto tax reporting. Take Sarah, for instance. After struggling with complicated spreadsheets, she found Krisp to be a game-changer. “It simplified everything,” she said, praising the software’s user-friendly interface.

Then there’s Mark, who used to dread tax season every year. With Krisp, he was able to file his taxes in record time. “I saved hours,” he remarked enthusiastically about the efficient tools provided by Krisp.

Similarly, Lisa appreciated how much money she could save on potential penalties due to misreporting her transactions. “It’s worth every penny,” she stated confidently.

These stories highlight just a fraction of how individuals have benefited from adopting Krisp into their financial routines. Each testimonial reflects satisfaction and a newfound ease when managing cryptocurrency investments and taxes.

Comparison to other crypto tax software options

When considering crypto tax software, it’s essential to evaluate how Krisp stands against other options on the market. Many competitors offer various features, but few can match the comprehensive approach that Krisp provides.

Krisp distinguishes itself through its user-friendly interface and seamless integration with major exchanges. While some alternatives might require complicated manual entries, Krisp automates much of this process. This means less time spent sifting through transactions and more focus on strategic investment decisions.

Additionally, security is a primary concern for cryptocurrency investors. Krisp employs advanced encryption methods to protect sensitive data better than many of its counterparts. This level of security gives users peace of mind as they navigate their tax obligations.

Pricing models also vary significantly among different software solutions. Krist offers competitive pricing structures tailored to individual needs without sacrificing quality or functionality—an advantage that sets it apart from pricier options that may not deliver equal value.

Moreover, customer support is another area where Krisp excels compared to others in the field. Users have access to prompt assistance whenever needed, ensuring any questions or issues are resolved quickly and effectively.

The combination of these factors makes Krisp an appealing choice for anyone looking to simplify their cryptocurrency tax reporting while maximizing savings both in time and money.