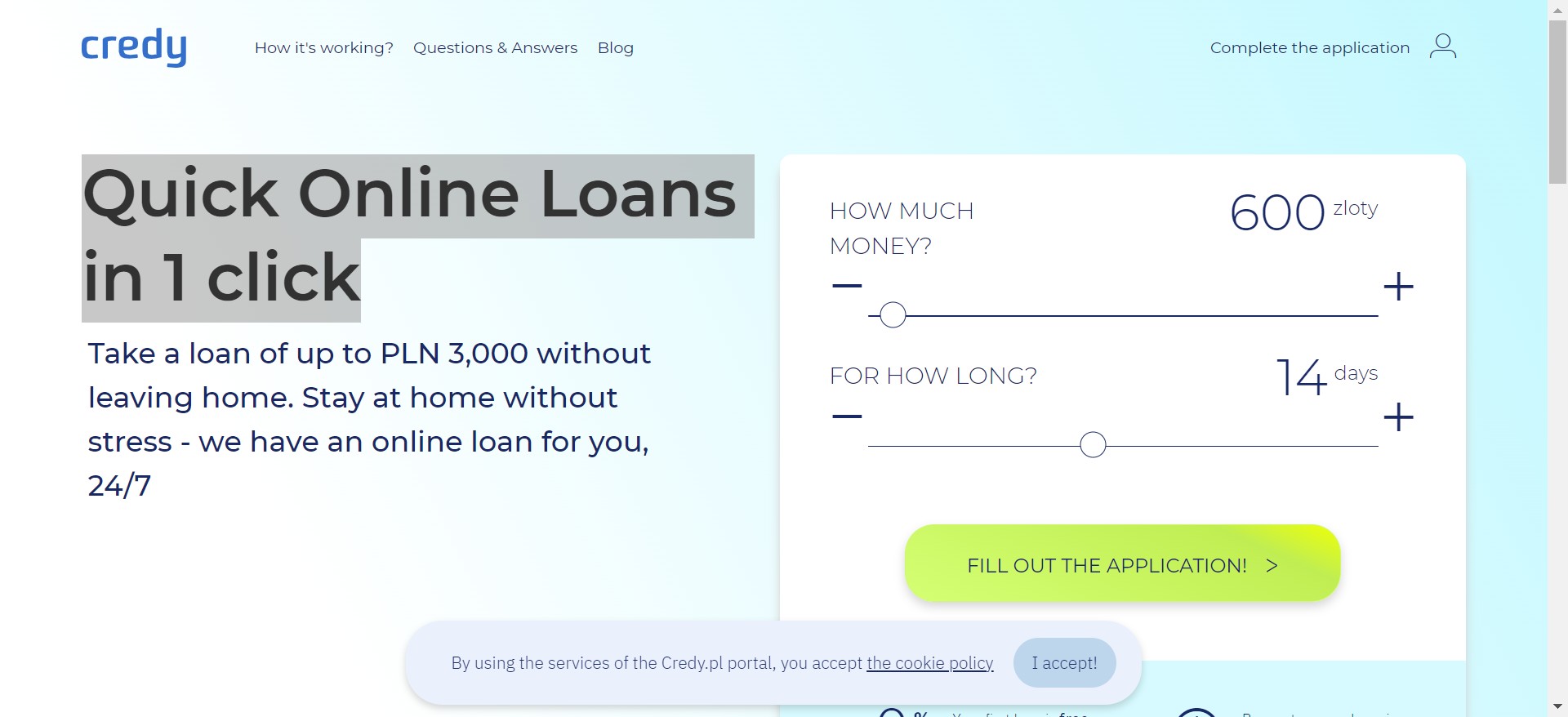

Are you tired of filling out lengthy loan applications and waiting days, or even weeks, for a response? Say goodbye to the traditional way of borrowing money because official-credy is here to offer quick online loans that can be secured with just a single click! In this blog post, we will explore the benefits of these fast and convenient loans, provide step-by-step instructions on how to apply for them, offer tips for choosing the right online loan option, and share valuable insights on avoiding scams and protecting your personal information. Get ready to experience a hassle-free borrowing process like never before!

The Benefits of Quick Online Loans with official-credy

When it comes to securing a loan, time is of the essence. With quick online loans from official-credy, you can say goodbye to lengthy paperwork and waiting for days on end for an approval. These loans offer a range of benefits that make them an attractive option for borrowers.

First and foremost, the application process is incredibly streamlined. Instead of filling out mountains of paperwork or making multiple trips to a physical location, all you need is a stable internet connection and a few minutes of your time. You can apply for a loan right from the comfort of your own home or even on-the-go using your mobile device.

Another advantage is the speed at which these loans are processed. Unlike traditional lenders who may take weeks to review your application and make a decision, official-credy strives to provide fast approvals. In many cases, you can receive funds in as little as 24 hours after approval.

Additionally, official-credy offers flexibility in loan amounts and repayment terms. Whether you need a small amount to cover unexpected expenses or require more substantial funding for larger projects, they have options available that cater to various financial needs.

Official-credy understands that not everyone has perfect credit scores. That’s why they consider applications from individuals with less-than-perfect credit histories or those who might have been denied by traditional lenders before.

Quick online loans with official-credy offer convenience, speedy processing times, flexible options,and accessibility regardless of credit history – all designed to meet the unique borrowing needs of today’s consumers without unnecessary delays or hurdles.

How to Apply for a Quick Online Loan with official-credy

So you’ve decided to apply for a quick online loan with official-credy, but you’re not quite sure where to start. Don’t worry, the process is simple and straightforward.

First, visit the official-credy website and create an account if you haven’t already. This will allow you to access their online loan application form. Fill in all the required information accurately and honestly.

Next, provide any necessary documentation that may be requested by official-credy. This could include proof of income, identification documents, or bank statements. Make sure to submit these documents promptly to avoid any delays in your loan approval process.

Once your application is submitted, sit back and relax while official-credy reviews it. They will assess your eligibility for a loan based on factors such as your credit score and financial history.

If approved, you will receive a notification from official-credy regarding the details of your loan offer. Carefully review the terms and conditions before accepting the offer.

Once you have accepted the offer, funds will be deposited into your designated bank account in a timely manner.

Applying for a quick online loan with official-credy is convenient and hassle-free! So why wait? Get started today and secure the financial assistance you need with just a few clicks!

Tips for Choosing the Right Online Loan Option

When it comes to choosing the right online loan option, there are a few tips that can help you make an informed decision. First and foremost, do your research. Take the time to compare different lenders and their terms and conditions. Look for reviews or testimonials from other borrowers to get a sense of their experiences.

Next, consider your specific needs and financial situation. Are you looking for a short-term loan or a longer repayment period? Do you need a large sum of money or just a small amount? Understanding your own requirements will help you narrow down the options available to you.

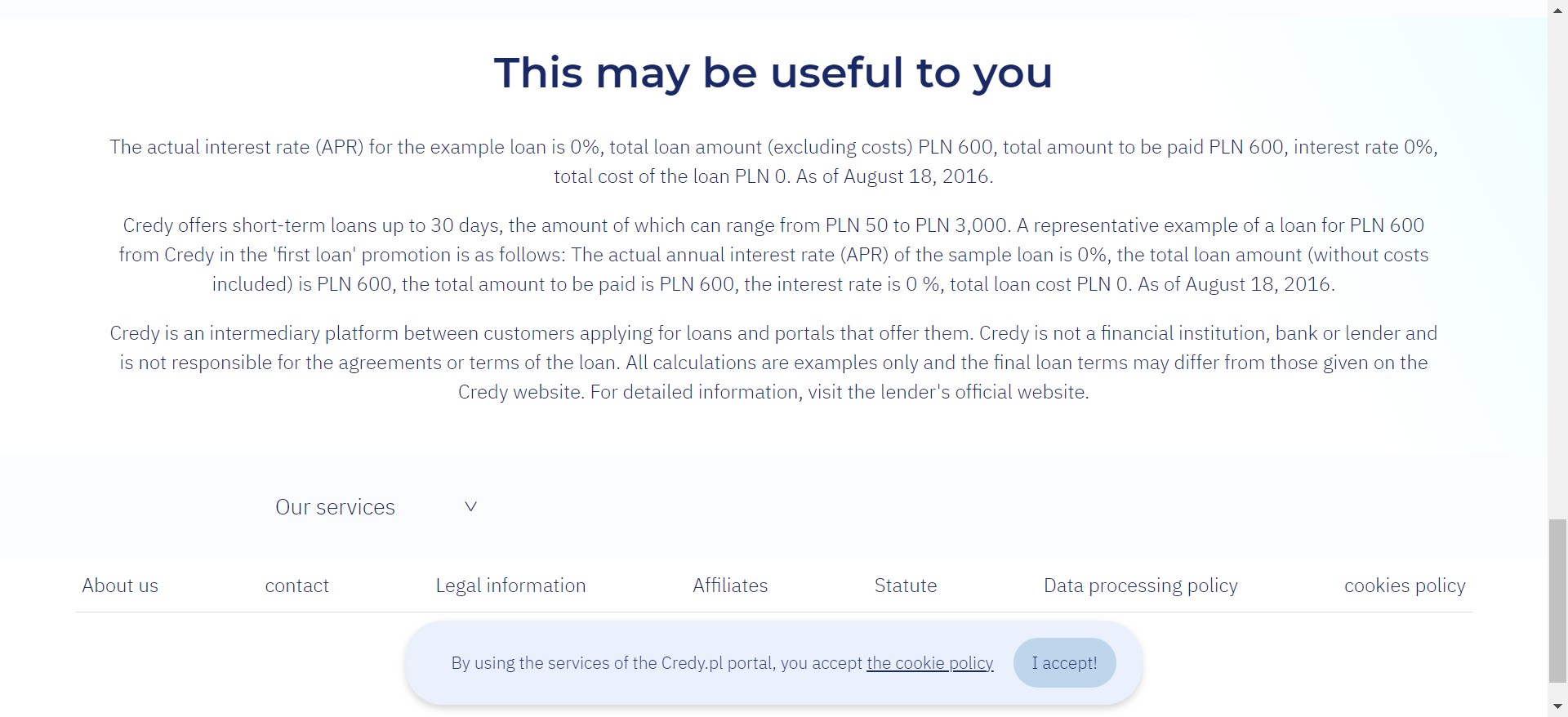

It’s also important to read the fine print before committing to any loan agreement. Make sure you understand all the fees, interest rates, and repayment terms associated with the loan. If something seems unclear or too good to be true, don’t hesitate to reach out to the lender for clarification.

Additionally, take into account any additional services offered by the lender. Some may provide flexible repayment options or allow early repayments without penalty fees. These features can make managing your loan easier in the long run.

Trust your instincts when choosing an online loan option. If something feels off or if you have doubts about a particular lender, it’s best to look elsewhere. Your financial well-being is at stake, so don’t rush into any decisions without careful consideration.

By following these tips, you’ll be better equipped to choose the right online loan option that suits your needs and helps secure quick financing without unnecessary hassle!

Avoiding Scams and Protecting Your Personal Information

Protecting your personal information is of utmost importance when applying for quick online loans. With the rise in online scams and fraudulent activities, it is crucial to be vigilant and take necessary precautions. Here are some tips to help you avoid scams and safeguard your personal data:

1. Research the Lender: Before choosing an online loan provider, thoroughly research their reputation and credibility. Look for reviews or testimonials from previous customers to ensure they have a good track record.

2. Verify Website Security: When applying for a loan online, make sure the website has secure encryption protocols in place. Look for “https” at the beginning of the URL and a lock icon in the address bar, indicating that your data will be transmitted securely.

3. Read Terms and Conditions Carefully: Take time to go through all the terms and conditions before submitting any personal information or agreeing to any loan agreement. Pay attention to interest rates, repayment terms, fees, and penalties.

4. Be Wary of Upfront Fees: Legitimate lenders generally do not require upfront fees or payments before approving a loan application. If a lender asks for money upfront without providing any services first, it’s likely a scam.

5. Protect Your Personal Information: Never share sensitive information like your social security number, bank account details, or passwords unless you are confident about the lender’s authenticity.

6. Use Secure Internet Connections: Avoid using public Wi-Fi networks when applying for an online loan as they may not be secure enough to protect your personal data from potential hackers.

7. Monitor Your Accounts Regularly: Keep track of your bank accounts and credit reports regularly to identify any suspicious activity promptly.

Remember that official-credy takes stringent measures to ensure customer privacy and data protection throughout its entire lending process.

By following these guidelines when applying for quick online loans with official-credy or any other reputable lender,

you can enjoy fast funding without compromising on security.

So say goodbye to lengthy loan applications and secure your quick online loans with official-credy in just