Freelancing has become a defining feature of the modern digital economy, offering professionals the freedom to work independently, choose their own clients, and shape careers around personal skills and passions. While this independence creates exciting opportunities, it also introduces responsibilities that traditional employment usually manages, especially in areas like accounting, taxation, and financial organization. Many freelancers struggle with tracking income, preparing invoices, calculating taxes, and staying compliant with regulations. Platforms such as Indy.fr are designed to simplify these complex processes, allowing independent professionals to focus more on growth and creativity rather than administrative stress.

Understanding the Financial Challenges of Freelancing

One of the biggest hurdles freelancers face is managing irregular income and scattered financial records. Payments may arrive from multiple clients at different times, expenses must be tracked carefully, and tax obligations often feel confusing without structured guidance. Without clear systems, freelancers risk missing deadlines, underestimating taxes, or losing visibility into their financial health. These challenges highlight the importance of reliable accounting tools and organized financial workflows that support long-term stability rather than short-term survival.

The Role of Freelance Accounting in Business Success

Accounting is more than simple bookkeeping; it is the foundation of a sustainable freelance business. Clear income tracking, organized expense categorization, and accurate financial reporting allow freelancers to understand profitability and plan future growth. Effective accounting also supports better pricing decisions, ensuring that services remain financially viable. Indy.fr aims to make freelance accounting accessible by reducing manual calculations and presenting financial data in a simplified, user-friendly format that supports confident decision-making.

Simplifying Tax Help for Independent Professionals

Tax management is often the most stressful part of freelancing, especially for individuals unfamiliar with financial regulations. Deadlines, deductions, reporting requirements, and payment schedules can become overwhelming without proper assistance. Reliable tax help tools provide automated calculations, reminders, and structured reporting that reduce the risk of penalties or mistakes. By clarifying obligations and simplifying compliance, Indy.fr helps freelancers approach taxes with confidence rather than anxiety.

Streamlined Invoicing and Payment Tracking

Professional invoicing plays a crucial role in maintaining steady cash flow. Clear, timely invoices improve client communication and reduce payment delays. Digital invoicing systems also allow freelancers to monitor unpaid bills, track payment history, and maintain organized financial records. Automation in invoicing reduces repetitive administrative work, freeing time for productive tasks. Integrated tools such as those offered by Indy.fr support smoother financial operations and improved professionalism.

Real-Time Financial Visibility and Planning

Access to real-time financial information empowers freelancers to make informed decisions. Seeing current income levels, upcoming tax obligations, and monthly expense patterns allows better budgeting and strategic planning. Instead of reacting to financial surprises, freelancers can prepare in advance and maintain stability. Indy.fr focuses on providing clear dashboards and insights that transform complex numbers into understandable guidance for everyday business management.

Time Savings Through Automation and Integration

Administrative work can consume valuable hours that freelancers would rather spend serving clients or developing new opportunities. Automation reduces repetitive tasks such as expense categorization, invoice generation, and report preparation. Integrated systems ensure that financial data remains organized without constant manual input. By saving time and reducing errors, Indy.fr allows freelancers to redirect energy toward creativity, productivity, and revenue growth.

Supporting Freelance Business Growth

Beyond accounting and taxes, structured financial tools contribute to overall business development. Accurate financial records improve credibility when applying for funding, partnerships, or long-term contracts. Clear profit tracking helps freelancers identify which services generate the most value. Growth becomes easier when operational foundations are stable and transparent. Indy.fr supports this journey by combining financial clarity with practical usability tailored to independent professionals.

Security and Trust in Digital Financial Platforms

Handling sensitive financial information requires strong security and reliable infrastructure. Freelancers must trust that their data remains protected and accessible when needed. Secure systems, consistent performance, and transparent processes build confidence in digital financial platforms. Choosing dependable solutions ensures peace of mind alongside convenience, making security a fundamental part of freelance financial management.

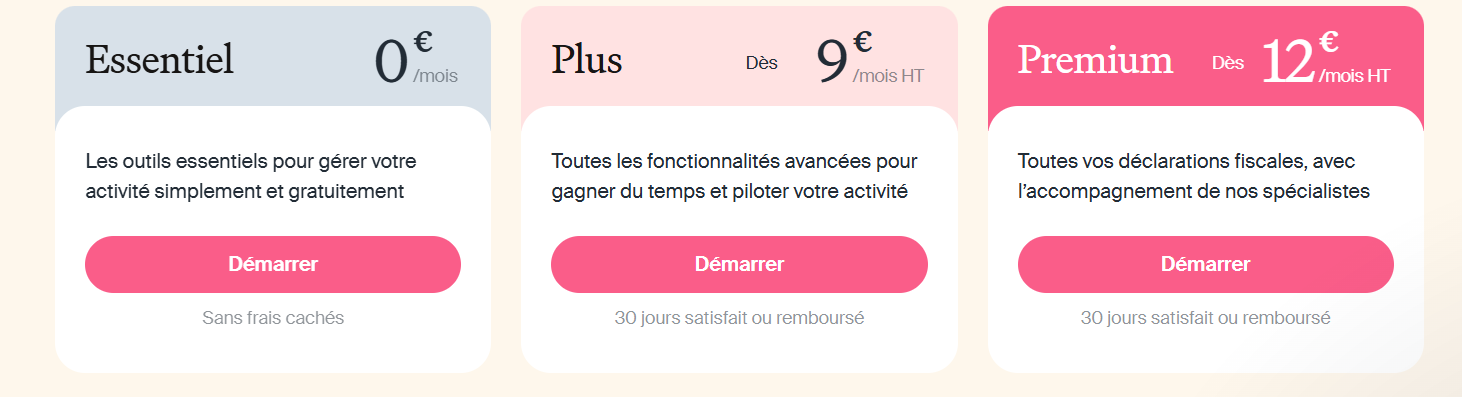

The Future of Freelance Accounting and Tax Solutions

As freelancing continues to expand worldwide, digital financial tools will become even more essential. Automation, real-time analytics, and simplified compliance processes are shaping the next generation of freelance support systems. Platforms like Indy.fr represent this evolution by combining usability with professional-level financial management. The future of freelancing will likely depend on tools that reduce complexity while empowering independence.

Practical Tips for Freelancers Using Financial Tools

Freelancers can maximize the benefits of accounting platforms by maintaining consistent financial habits. Recording expenses regularly, reviewing financial summaries, and planning tax payments in advance create long-term stability. Setting clear pricing structures and monitoring cash flow also support sustainable growth. When combined with reliable tools like Indy.fr, these habits transform freelancing from uncertain work into a structured and scalable business.

Final Thoughts on the Ultimate Indy.fr Review

Freelancing offers unmatched flexibility and creative freedom, but financial management remains a critical responsibility that cannot be ignored. Reliable freelance accounting systems, clear tax help, and efficient business tools are essential for turning independence into lasting success. Indy.fr stands out as a platform designed to simplify these challenges, offering structured support that reduces stress and improves financial clarity. With the right tools and disciplined financial practices, freelancers can focus on delivering quality work, expanding opportunities, and building stable, rewarding careers in the evolving digital economy.