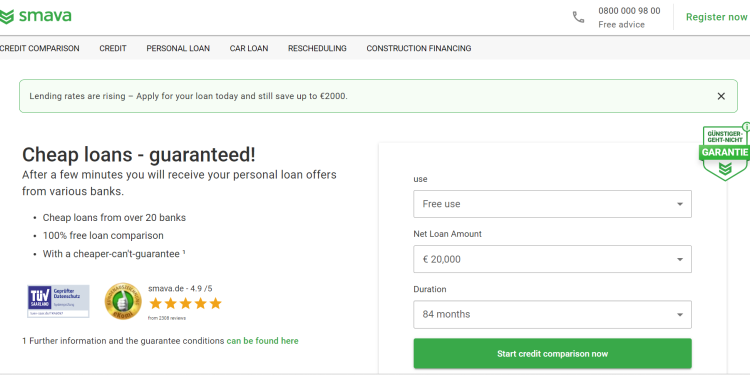

Smava: Vehicle loan with immediate payment for cars and motorcycles

Have you ever wished you could get a car or motorcycle without having to wait months or even years for it to be delivered? Well, Smava may be the solution for you. Smava is a vehicle loan with immediate payment options that allow you to get a car or motorcycle as soon as possible. With Smava, there are no long waiting periods or hidden fees. You can simply decide what you want and take it off the shelf—no negotiations necessary. Plus, with Smava, you can use the money you borrow to purchase a car or motorcycle outright, making it easier for you to pay for it in full and have ownership of the vehicle. Check out Smava today and see how easy and convenient vehicle loans can be!

What are the benefits of using Smava?

The benefits of using Smava for vehicle loans are numerous. Loans can be taken out quickly and with no credit check, making them an ideal option for those in a hurry. Additionally, Smava offers competitive rates and the ability to pay back the loan early without penalties. With Smava, you can also borrow money for cars and motorcycles.

There are many benefits of using Smava. The main benefit is that you can get a vehicle loan with immediate payment. This means that you can get the money you need right away and not have to wait for a period of time. This is an important feature, especially if you need the money quickly. Another benefit is that Smava offers competitive rates. So, even if you have a low credit score, you may still be able to get a good loan through Smava. Finally, Smava has a wide variety of loans available, so you are sure to find one that meets your needs.

How do I apply for a Smava loan?

If you are looking for a vehicle loan with immediate payment, Smava is the perfect solution for you. To apply for a Smava loan, simply complete the online application form and submit it to our lender. You will then be contacted by one of our representatives to discuss your eligibility and financing options. Once you have been approved for a Smava loan, you will receive an automatic funds transfer into your bank account, so there is no need to wait long for your cash infusion. Plus, because Smava loans are short-term loans, you can take advantage of low interest rates and fast funding times to secure the best deal possible. So what are you waiting for? Apply today and get started on your dream car or motorcycle purchase!

Can I use Smava to buy a car or motorcycle?

Smava is a new vehicle loan with immediate payment for cars and motorcycles. This unique service allows you to borrow money from Smava and have the funds deposited directly into your bank account, so you can buy your car or motorcycle immediately.

Simply fill out our online application and we’ll take a look at your credit history. Once approved, you will receive an email with all of the details about how to proceed. There is no need to go to a dealership or spend hours looking through different options – Smava can provide you with a competitive loan rate and immediate access to funds.

So why wait? Apply today and get started on your dream car or motorcycle!

How to apply for a Smava loan

If you’re interested in applying for a Smava vehicle loan, there are a few things that you’ll need to do first. First, you’ll need to create an account with the Smava platform. This can be done by visiting their website and filling out an online application form. Once you’ve created your account, you’ll need to input the information about your car or motorcycle. This will include the make, model, and year of your vehicle. Next, you’ll need to provide proof of ownership for your vehicle. This can be anything from a registration document to a car insurance policy. Finally, you’ll need to provide bank information and proof of income. Once all of this information has been collected, it will be processed and you should receive a confirmation notification from Smava shortly after.

Smava is a new car loan service that offers borrowers immediate payment for cars and motorcycles. Borrowers can use Smava to buy a car or motorcycle with no downpayment required and no credit check. The service also offers competitive interest rates and flexible repayment options, making it an ideal option for those looking to purchase a vehicle without having to worry about financing costs.

To use Smava, borrowers first need to create an account. Once they have an account, they can start borrowing money by filling out a simple application. borrowers can choose from a variety of repayment options, including monthly payments, interest-free payments, and payback plans. There is also no need to worry about late payments or missed payments – Smava automatically calculates and pays back loans on schedule.

For those looking for a convenient way to purchase a car or motorcycle without any hassle, Smava is the perfect option. With immediate payment options and competitive interest rates, Smava is sure to offer customers the best possible deal on vehicle purchases.

What are the terms of a Smava loan?

What are the terms of a Smava loan?

The terms of a Smava loan are simple and straightforward. The loan is available in denominations of €5,000 and up, and the minimum required investment is €1,000. Once you have invested in a Smava loan, you can immediately start receiving payments on your vehicle. You can also withdraw your money at any time without penalty.

What are the repayment options for a Smava loan?

There are a variety of repayment options for a Smava loan, depending on the length of the loan and whether you have to make monthly payments or lump-sum payments.

If you have to make monthly payments, you’ll need to factor in interest and fees when calculating your total cost. The following table shows the total cost of various payment options:

Option Total Cost Monthly Payment Option 1 $128.39 $10.92 Option 2 $131.12 $11.86 Option 3 $136.78 $13.62 Option 4 $141.42 $14.28

If you want to make a lump-sum payment, you’ll need to know how much money you want to borrow and how long you plan on keeping the car or motorcycle. The following table shows the total cost of various lump-sum payment options:

There are several risks associated with using a Smava vehicle loan. The most important risk is that the loan may not be repaid in a timely manner, resulting in significant financial damage to both the borrower and the lender. Additionally, the Smava vehicle loan may not be approved by a bank or other lending institution, which could lead to economic difficulties for both parties involved.